Zoopla Market Rankings 2026

13 Jan 2026We’ve ranked every UK postcode area by its growth potential in 2026, based on key market indicators. How does your area stack up?

Read more

Richard Donnell shares the key themes and data-led forecasts for the 2026 estate agency landscape, as presented at the recent Negotiator Conference & Awards.

It was a pleasure to speak at The Negotiator Conference & Awards in London at the end of last year. Sharing the stage with industry leaders and connecting with the agency community is always a highlight of the year.

In my keynote speech ‘Market landscape for estate agency in 2026’, I shared the latest data insights that we believe will define the next 12 months.

For those who couldn't attend or who want a refresher, I’ve attached the slides below and summarised the key themes we discussed for the year ahead.

Download my Market Landscape slide deck (PDF, 224kB)

Please note that we’ve revised some of the presentation’s forecasts in recent weeks, based on the latest data. See our latest House Price Index for our updated expectations for 2026.

Indicator | 2026 forecast | Context |

Value of estate agency - sales and lettings | +4% to 6% | Growth driven by service fees and professional advice. |

Sales volumes | 1.18 million | Housing sales volumes to edge lower to 1.18m in 2026 |

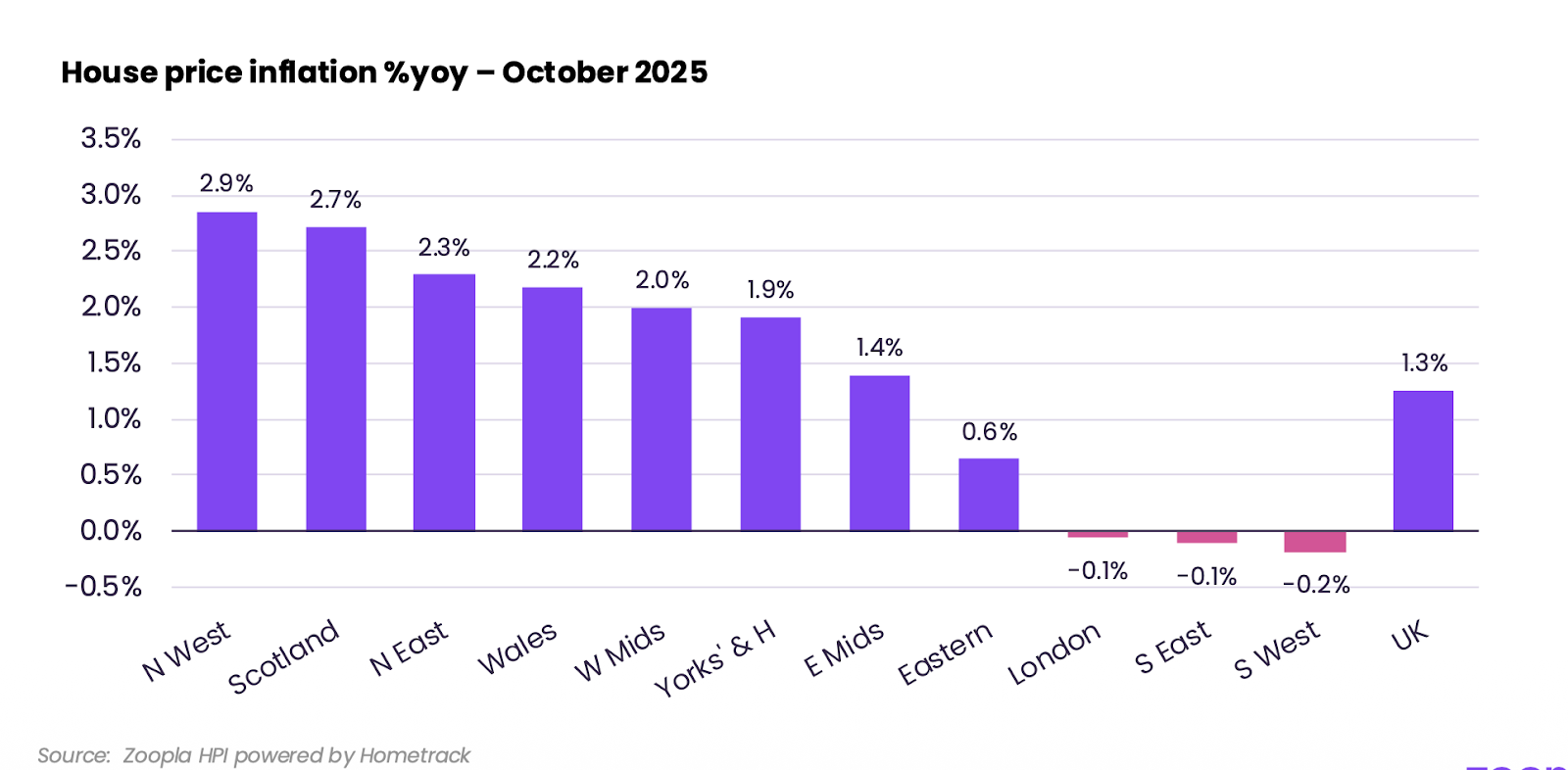

House price Inflation | 1% to 3% | Higher in northerly and affordable hubs; lower in the South. |

Rental inflation | 2% to 4% | Normalising after years of double-digit growth; higher in more affordable markets. |

The 2026 sales market was characterised by a significant rebuilding of the sales pipeline. We have entered the year with the largest sales pipeline in 4 years, representing more than £1bn in potential sales commission.

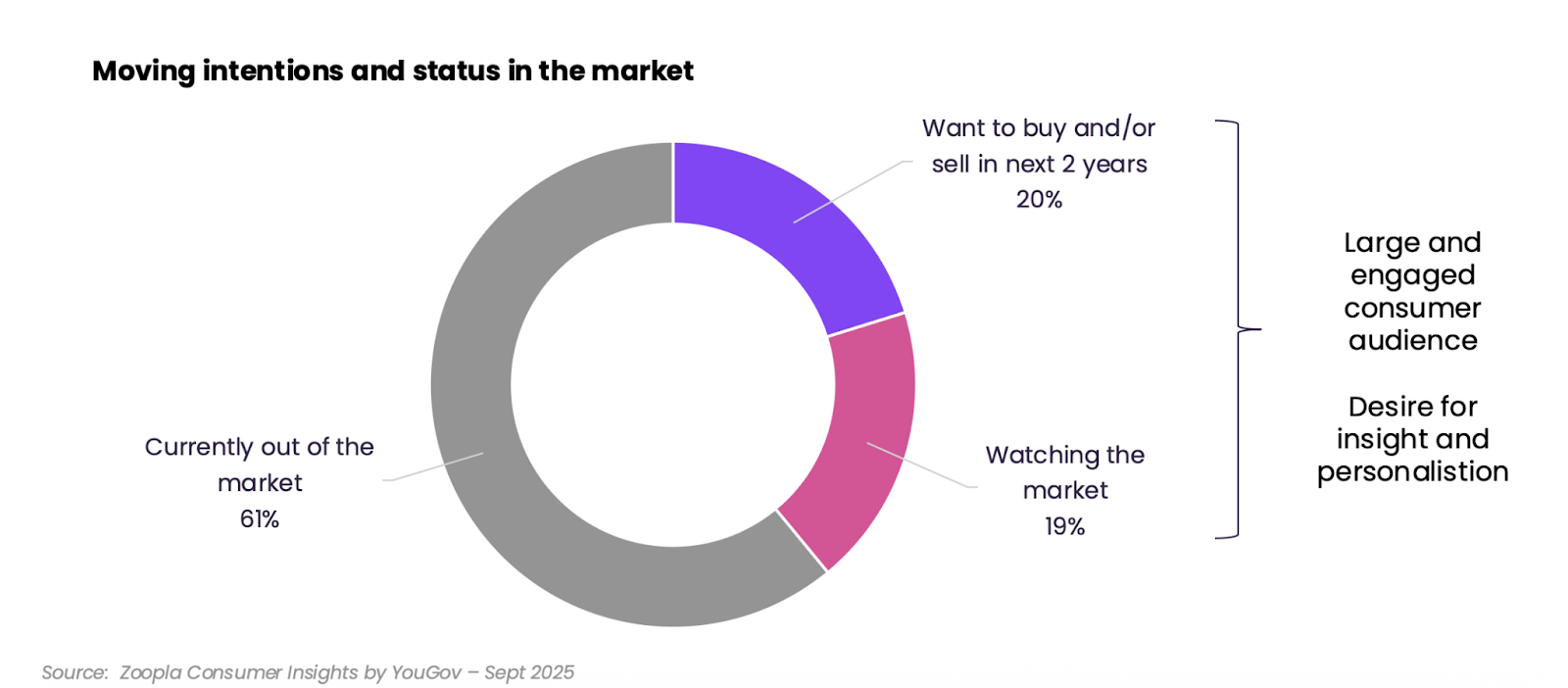

2 in 5 consumers are currently “watching” or “in” the market, but value and price are central to decisions. Converting this interest and winning instructions requires agents to move beyond listings toward deep engagement. This is where the Zoopla homeowner ecosystem becomes a critical partner, capturing prospects earlier and delivering them as high-intent leads to our partners.

First-time buyers continue to drive the market, accounting for 40% of all sales in 2025. However, the lack of churn in entry-level stock means it’s harder work to find homes for these motivated buyers.

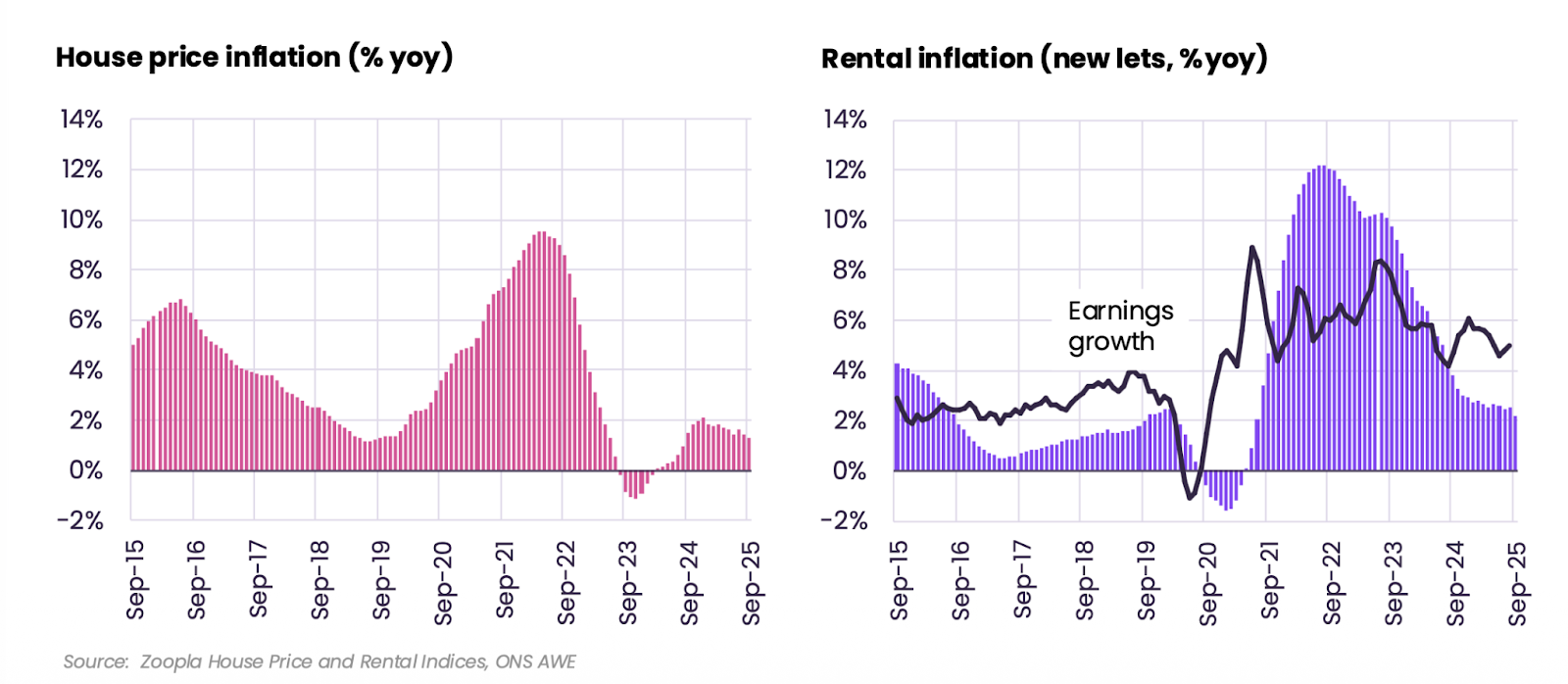

House price inflation remains muted at 1-3% but there is no single UK market, with significant divergence across the country. Southern England is feeling the drag of affordability and stamp duty costs much more acutely than more affordable northern markets.

As such, hyper-local awareness is even more vital in 2026. It was great to hear our insights tools are central to many of your client conversations, with data from MarketView, Comparables Reports and Property Valuation Reports helping you win in the living room.

Find out more about the £1bn opportunity

Stop guessing and start growing. Our team can help handpick the right products to win more customers in your local market.

While rents have surged by 35% over the last five years, boosting agency management revenues, the sector is at a crossroads.

Rental inflation for new lets is at its slowest pace in four years (2-4%). The extreme supply/demand imbalance seen in recent years is finally beginning to steady.

An early shift in strategy will benefit letting agents this year, if you haven’t already started to adapt. Tenants have more choice and less urgency, and results will depend more on listing visibility and marketing approach. I spoke to several letting agents at the Awards about their recent performance with our listing products, which are helping them secure the best tenants more quickly.

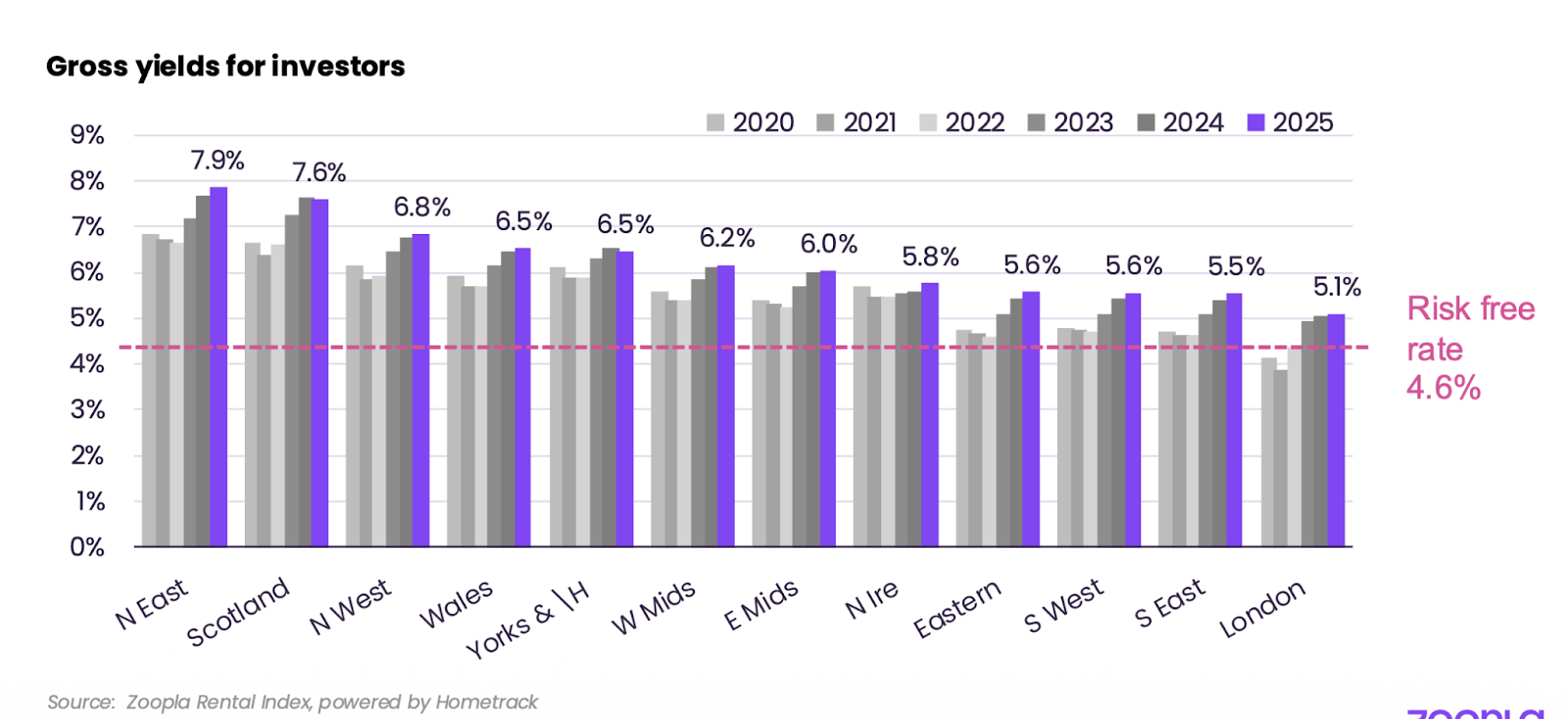

The "amateur" landlord is being replaced by professional investors who are consolidating portfolios. We expect a slow recovery in landlord acquisitions, though this remains sensitive to the ‘risk-free rate’ of return on other investments.

With the complexity of the Renters' Rights Act now fully in play, the value of professional letting agency is set to increase by 4-6% this year as landlords seek compliance and stability.

Tap into our well-known brand, unique audiences and pipeline of motivated movers.

We try to make sure that the information here is accurate at the time of publishing. But the property market moves fast and some information may now be out of date. Zoopla accepts no responsibility or liability for any decisions you make based on the information provided.

We’ve ranked every UK postcode area by its growth potential in 2026, based on key market indicators. How does your area stack up?

Read more

Buyers are returning to the housing market as confidence improves and mortgage rates fall, but a growing number of homes for sale is giving more choice and reshaping market conditions across the country.

Read more

Our new research shows that while the industry may be busy polishing its automation tools, sellers are gently reminding everyone that property decisions are still deeply personal - although this does vary across groups of consumers.

Read more