UK house prices increase 1.2% over 2025

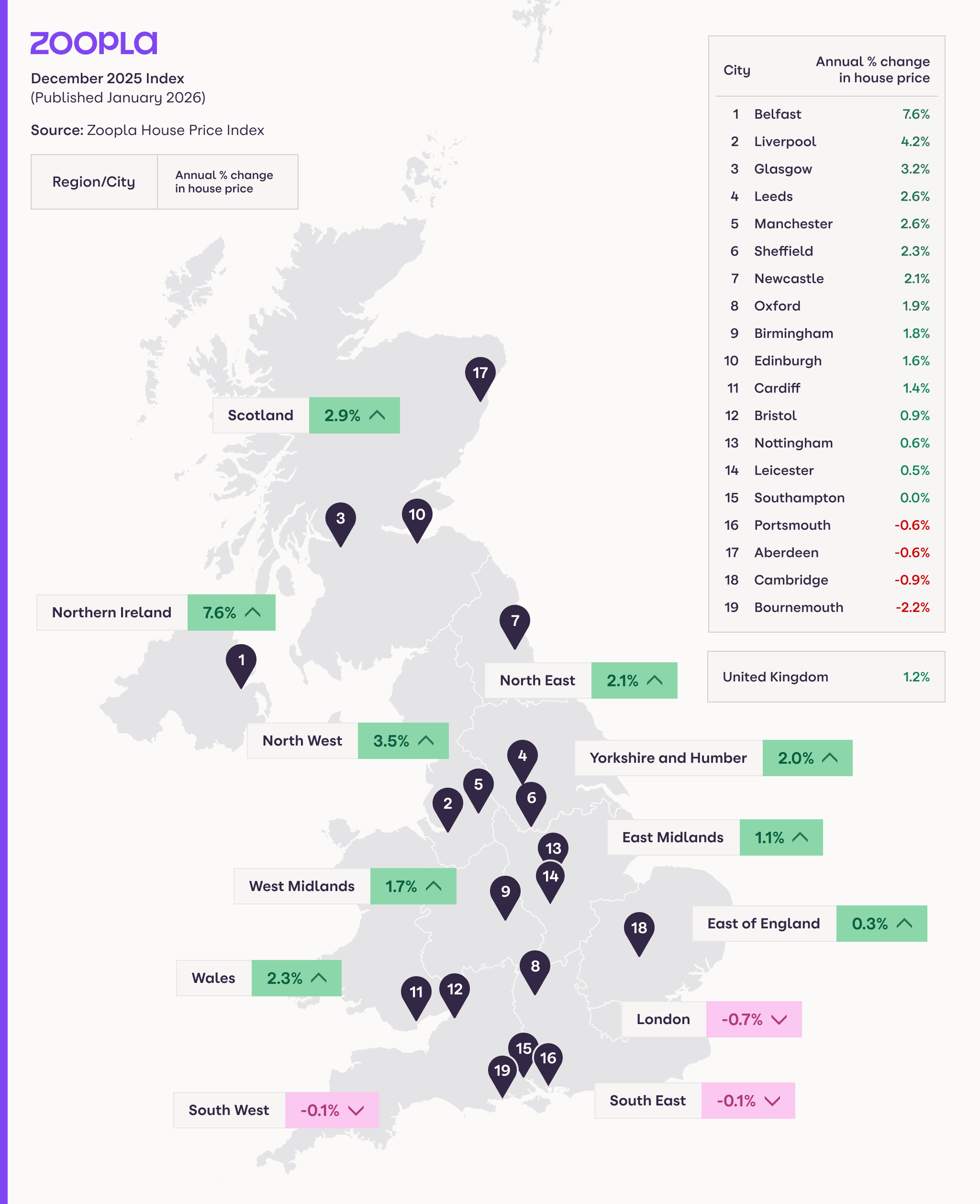

Market conditions vary across the country. The average UK house price increased by 1.2% over the last 12 months, increasing by £3,200 to stand at £269,800 at the end of 2025.

Prices have increased up to 4 times faster in more affordable parts of the Midlands, Northern England, Scotland and Northern Ireland.

In contrast, smaller price falls of -0.1% were recorded across the South East and South West regions.

Buyers in the South of England are more price-sensitive due to higher buying costs and a greater supply of homes for sale. London now has significantly more homes on the market than a year ago, reinforcing a buyers’ market in the capital and pushing prices lower over 2025.

While the national 1.2% rise is a useful headline for general confidence, the reality on the ground is far more fragmented than even the regional picture. Whether you’re defending a fee in a growth area or managing a price reduction in a more sensitive southern market, local context is the difference between a property that’s priced to sell and one that takes 6 months to move.

Average house prices by property type

| October 2025 | November 2025 | December 2025 | Annual price change (£) | Annual price change (%) |

All UK property | £269,700 | £269,800 | £269,800 | £3,190 | 1.20% |

Flats/maisonettes | £191,700 | £191,900 | £191,400 | -£2,810 | -1.40% |

Terraced houses | £238,900 | £238,800 | £239,100 | £3,910 | 1.70% |

Semi-detached houses | £277,500 | £277,600 | £277,800 | £6,080 | 2.20% |

Detached houses | £453,100 | £452,500 | £453,000 | £5,330 | 1.20% |

Outlook

We expect current trends in market activity to continue over the early part of the year. The desire to move is clearly there, but it’s a high-choice environment.

Success in the first half of 2026 will come down to active portfolio management - identifying the properties that need a refresh in presentation or a price alignment before they become part of the background noise.