After a sluggish end to 2025, it’s positive to see a strong rebound in buyer demand over the first weeks of the year across all parts of the country.

Growing numbers of homes for sale is evidence of a strong underlying appetite to move home for many households. Market conditions vary widely across the UK, and sellers looking to move home in 2026 need to be encouraged to take this into account when planning their home move.

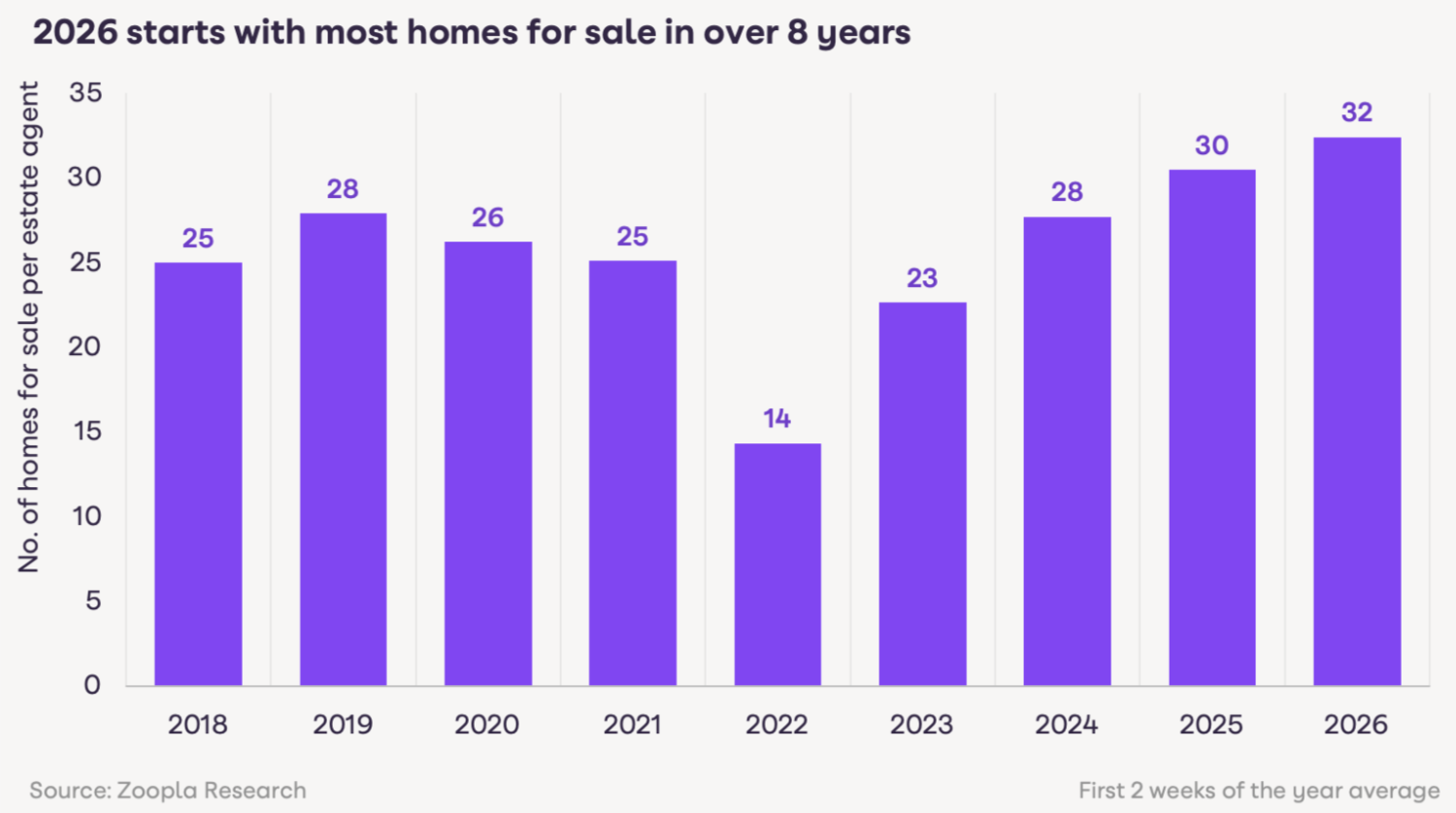

Most homes for sale in 8 years

2026 started with the average agent having 32 homes for sale, the highest level in early January since 2018.

The stock of homes for sale has increased over recent years, highlighting a continued desire amongst homeowners to move home.

However, not all these homes are brand new to the market. 33% were previously listed in 2025 and have been brought back to market following the uncertainty that reduced market activity over the final quarter of 2025.

Most of UK sees steady supply and a degree of scarcity

Across most regions of the UK, supply is broadly the same as last year which is generating a degree of scarcity. This is supporting price inflation, most noticeably in the North West where house prices are up to 3% higher than a year ago.

Buyers are active but careful, which means pricing correctly from the outset is crucial. The market is stable rather than booming. Homes that are well-presented and well-priced continue to sell, while those priced optimistically will take longer and may need price reductions to attract interest.

London and South East register most homes for sale compared to a year ago

The growth in the number of homes for sale compared to a year ago is greatest in London, up 16% on last year followed by the South East, up 9%.

Southern regions were most impacted by Budget uncertainty which stalled sales in the final months of 2025 meaning more homes carried over into 2026.

More supply is boosting choice for home buyers and keeping price inflation in check across southern England where prices are lower by up to 1% in the last year.

Buyers are price-sensitive and have more choice, so achieving the best result depends on setting a competitive asking price and attracting early interest.

Homes priced too high often take longer to sell and at the risk of achieving a lower price. It’s important to price carefully and tailor your strategy to the local market, property type and home’s condition to achieve a sale in current conditions.

Buyer demand rebounds but 10% short of strong start to 2025

Our latest data shows a strong rebound in buyer demand post-Christmas which is in line with previous years and tracking in line with the early weeks of 2024. It’s over 20% ahead of the start to 2023 and the pre-pandemic years (2017-2019).

More homes for sale mean more buyers looking to secure a sale and move home in 2026.

This shows a sustainable increase in demand that we expect to increase further in the coming weeks. This will support continued growth in housing sales over 2026.

However, the rebound in demand to date is tracking 10% behind the very strong start to 2025 when the ending of stamp duty reliefs and lower mortgage rates provided additional stimulus to the level of demand for homes.